Will FY2016 be the year for children? Or déjà vu?

February 4, 2015

In January’s State of the Union address, President Obama highlighted several initiatives meant to simplify child care for America families. The White House’s budget proposal for Fiscal Year 2016, released on Monday, provides further insight into the costs and details of these programs as well as additional areas of focus within the early childhood world.

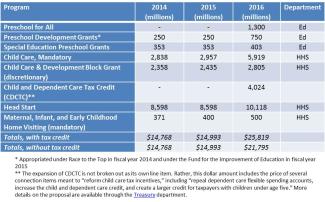

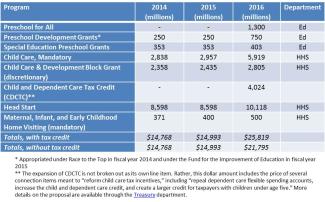

Early childhood education is often referred to as a “patchwork” system in reference to the number of public and private stakeholders–with varying program requirements and goals–who are involved, and the federal budget is no exception. Several departments have larger programs that operate projects in early childhood education. The Department of Education oversees Special Education Preschool Grants and houses the current Preschool Development Grants program, as well as the President’s proposed Preschool for All program. The Department of Health and Human Services (HHS) also collaborates on the Preschool Development Grants program. HHS oversees Head Start, child care, and the Maternal, Infant, and Early Childhood Home Visiting (MIECHV). The President has also proposed expanding the current tax benefits for families paying for child care–a complex change to tax policy which would not be covered by either department as it is not itself a program.

Much of what the White House is proposing in this budget has been seen before. The Preschool for All program is similar to the version proposed in the FY 2014 budget, and the Preschool Development Grants seek to distribute funds to more states than those already awarded grants in FY 2015. A review of budget documents from the Education and HHS departments does reveal some suggested changes:

- Special Education Preschool Grants would include appropriations language that would allow LEAs to expand the age range of eligible children to include children ages 3 through 5, as well as requesting a waiver of some reporting requirements for LEAs that exercise this flexibility.

- Head Start requested an additional $1.1 billion to expand service to full-day and school-year calendars. There is also $150 million for Early Head Start and EHS-Child Care partnerships as well as $284 to help existing programs offset rising costs.

- Child Care: In the requested increase, there is a proposed $266 million to implement the reauthorized Child Care and Development Block Grant Act. There’s also a requested $100 million for Child Care Pilots for Working Families, which would test and evaluate models for working families, including those who work nontraditional hours. The administration has also introduced a 10-year, $82 billion plan for mandatory funding for the Child Care and Development Fund, to ensure that all low-income working families with children ages three or younger have access to quality, affordable child care.

- An expansion of the Child and Dependent Care Tax Credit (CDCTC) up to $3,000 per child would triple the maximum credit for families with children under age five and makes the full CDCTC available to families with incomes of up to $120,000. While this credit is largely discussed as a way to help parents pay for the care of their young children, it can also be used for older children and dependents who are elderly or have disabilities.

The Obama administration has touted this budget as crucial to progress for the middle class. These proposals focused on the early years on life would fill major gaps in service for many of America’s children–children in low-income families who do not have quality care while their parents work; children whose families feel the “middle class squeeze” and could greatly benefit from the increased CDCTC; children with special needs for whom quality early intervention services can make a world of difference. However, two essential questions should be asked about each element of the proposal. First, is it designed in such a way that it will significantly improve the quality of children’s early educational experiences? Much of the potential benefit to children and society depends on the answer. Second, what is the potential for passage? Without support across the aisle, as well as at the state level, these proposals will remain just proposals. Recent experience suggests that, at least for education, proposals designed to help every child will be better received than those that exclude the families expected to pay for them.

– Megan Carolan, Policy Research Coordinator

About NIEER

The National Institute for Early Education Research (NIEER) at the Graduate School of Education, Rutgers University, New Brunswick, NJ, conducts and disseminates independent research and analysis to inform early childhood education policy.